I am sorry to be a pedant but in that respect my pathology is derived from a long study of the opinions of HM judges who suffer from the same disability. Definitions are phenomenally important in tax statutes.

1 IHT RNRB

“Dwelling-house” is not defined in s 8H IHTA 1984. It does not import the definition from TCGA 1992 or any other Act. There is a very limited importation is subsection(7) of the meaning of “job-related” to determine whether it can be considered a residence. It is therefore to be interpreted as an ordinary English word, and may have been interpreted as such in context in other Acts, fiscal or otherwise. This is not wonderful news as this cavalier decision not to elaborate in more detail on its meaning has caused much unnecessary trouble in relation to SDLT.

2 CGT PPRR

“Dwelling-house” is not defined either in s222 TCGA 1992, confirmed as HMRC’s view in CG64230. HMRC do accept that the term is not restricted to houses as such: CG64305, 64309 and 64325.

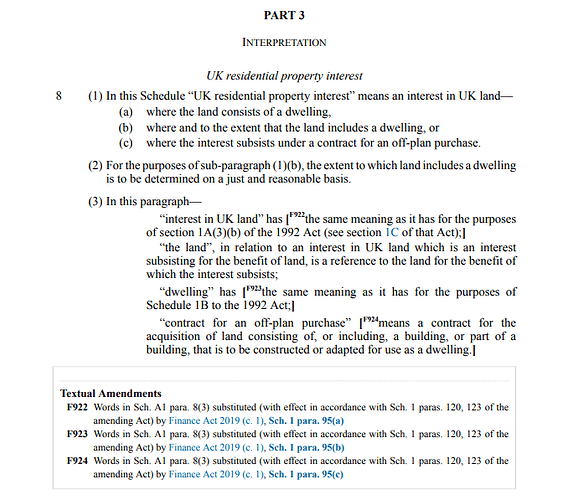

The word “dwelling” in para 5 Sch 1B TCGA is defined but has nothing to do with s222: it applies to determine whether or not a person has made a “disposal of residential property” for the purposes of applying the appropriate rate of CGT to the gain arising: s1H(2)(a).

That definition states that a building is a dwelling “for the purposes of this Schedule” if

(a)it is used, or suitable for use, as a dwelling, or

(b)

it is in the process of being constructed or adapted for use as a dwelling

It could not be clearer that it is not intended to interpret wording in s222. It is open to a Court, of course, to decide that “dwelling-house” has that meaning but not by applying Schedule 1B.

3 SDLT

An important component for rate of charge is the definition of “residential property” which includes “a building that is used or suitable for use as a dwelling, or is in the process of being constructed or adapted for such use” s116 FA 2003. For the purposes of multiple dwellings relief a “dwelling” means a building or part of a building which is used or is suitable for use as a single dwelling or is in the process of being constructed or adapted for such use": Sch 6B. The same definition is employed for higher rate transactions in Sch4A and first time buyer’s relief in Sch6ZA. Note that HMRC consider a building “would need to be suitable for an occupant generally, not just for a particular type of occupant like a relative or a squatter”: SDLTM000415. However the definition is in the alternative: used OR suitable to be used which must encompass actually used although unsuitable.

These definitions cannot be implied into IHT and CGT though they too are not further defined and have their meanings in context as ordinary English words. It seems at least open to argument that, in the absence of these specific wider definitions, the words “dwelling-house” or “dwelling” would ordinarily exclude buildings not suitable for relevant use or under construction/adaptation but the contrary argument is that they are inserted, where they do appear, solely for the avoidance of doubt.

The lamentable failure of the legislature to define “dwelling” for SDLT led to myriad Tribunal decisions about granny annexes, staff quarters, and other varieties of supposed separate and multiple dwellings for MDR, exacerbated by scheme sales merchants predating possible refunds, nearly all claims for which failed. Guidance in SDLTM00410-00430 was published in October 2019 but had been asserted over many prior years in correspondence as HMRC’s view and should have been published as soon as it became settled, and even better legislated from 2003 in the definition. MDR is to be repealed after of 31 May 2024 but HMRC will still cavil about garden and grounds, when and if an incomplete building is “suitable” SDLTM00385, and whether land is residential or not or mixed.

4 The original query

I tend to agree with Malcolm that the legal niceties would not necessarily prevent an incomplete building from being a “dwelling house” and thus an “only or main residence” for CGT but it must surely depend on the degree of completion. CGT requires only that it should be objectively a “dwelling-house” and factually the residence of its owner. It does not strictly import the alternative test of “suitability” for SDLT or what HMRC identify as the criteria for a single dwelling being separate from another for that tax. There must be a point at which an incomplete building cannot yet be said to be a “dwelling-house” at all or “residence” even if the owner is living there after a fashion at a time when no one else would. I would certainly question whether that would be accepted by HMRC unless he genuinely lived there exclusively rather than tried to nominate it while also living elsewhere. Self-builders are never in any event totally free of the risk of s224(3) or trading: see CG65200 onwards.

Jack Harper