I have an estate with a joint property (mother & son). Son was given his share from father’s estate years ago. Mother & son executed declaration of Trust agreeing shares and including provision that mother could give notice requiring a sale (if that is relevant to my question).

The estate figures are such that if I discount the value of the half share it will reduce the available RNRB and thereby produce a taxable estate.

Am I obliged to discount the value?

I am not sure I see how reducing the value could cause the estate to be taxable if it isnt with a higher value unless you are using the RNRB to cover other assets which it shouldn’t

On the valuation point the executors are obliged to report the true market value so if a discount would apply then it should be applied in my view.

Because the value of the half share of the property is less than the available RNRBs

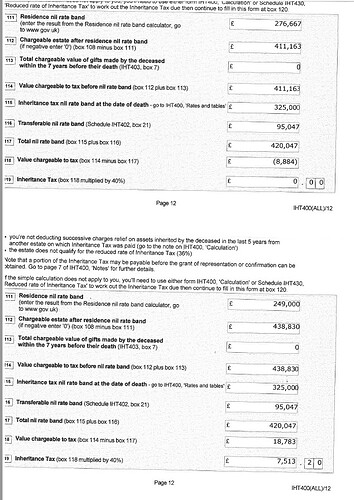

as maths is not my strong point I don’t understand why but the two calculations are

So the total of boxes 111 and 112 in both cases is £687830. in the second the RNRB has reduced by the amount of the discount i presume but has the form updated for the reduction in the value of the property?

If the value of the property before and after discount is covered by RNRB the value at box 112 should stay the same?

Thank you I had simultaneously realised my basic error so problem averted, sorry to waste your time

The discount, usually 10% but sometimes 15%, is allowed to reflect the unmarketability of the part interest. If that interest is coupled with a right to require the property as a whole to be sold, and if that would be transferable to a hypothetical purchaser, it might rule out the discount.

In a situation where the part owner’s estate is to be valued the statutory open market rule would dictate the assumption that the part interest and the right would be sold together. The leading cases on land are the Duke of Buccleuch (1967), where HMRC were allowed to assume the division of a huge estate into 532 separate units, and for shares the Mackie case (1952), where the management and preference shares together conferred control but not separately. This will apply where the whole estate is to be valued as it is for IHT on death and on a lifetime transfer to measure the loss to donor. See SVM113090

The assets can be quite disparate. In the Gray (or Lady Fox) case (1994) the deceased herself held two assets (a freehold of an estate subject to a tenancy to a farming partnership, and her 92.5% interest in the partnership which held the tenancy.

It may not matter that the right in this case is personal to the part owner as long as it is inherently unassignable in law. The Executors of McArthur (2008) shows that as SVM113140 says “Whilst the option agreements might be regarded as personal to the deceased, because IHT is charged on the value of a person’s estate, it was decided that the unit of valuation was the shares in each company plus the relevant conversion rights or options. The valuation was calculated on the basis that the shares and conversion rights under the loan agreement would be sold together as a package”.

THE VOA’s IHT Manual is very instructive on undivided shares https://www.gov.uk/guidance/inheritance-tax-manual/section-18-undivided-shares

For example:

"9.7 The level of discount to be applied when valuing an undivided half-share interest should therefore normally be as follows:

· where the other co-owner(s) is (are) not in occupation and the purpose behind the trust no longer exists - 10%

· where the other co-owner(s) is (are) not in occupation but they have a clear right to occupy as their main residence and the purpose behind the trust still exists - 15%

· where the other co-owner(s) is (are) in occupation as their main residence. - 15%

If the other co-owner is in occupation and the transferor has been excluded from possession, or is likely to be excluded from occupation, under Sec 13 TLATA 1996 (see para. 7.2 above), it will be necessary to look at any benefits obtained by way of compensation and compare the value of these benefits with the notional value of the interest on the assumption that exclusion had not been authorised."

Jack Harper

Oops! Should read “as long as it is NOT inherently unassignable in law”

Jack Harper.

Although C Hadfield’s query was resolved just before your posting, I have found your treatise very informative,

thank you.

Patrick Moroney

Why is a discount or its size a matter the executors or their advisers? Surely they should instruct the valuer to value the deceased’s share. That value provided should be 45% of the the value of the whole, if a 10% discount is appropriate. The instructions to the valuer shouldn’t be to value the whole and for the executors/advisers then to take upon themselves the task of valuing the deceased’s moiety. Why keep a dog and bark yourself?

I had assumed that the mother and son had entered into a DOT after the father’s death and before the mother’s, The original query did not even state whose death was in point but it did not matter as regards the comments I was making. After the DOT the half share of the property of either was to be valued on the basis that the mother had a right to demand a sale which would devolve on her PRs with her half share, again unless the DOT stated to the contrary which we were not told.

The executors have a responsibility to deal with the estate’s IHT liability which necessarily involves valuing a half share with any intrinsic rights attaching to it. That requires it to be established whether a discount from valuing the entirety and dividing it by 2 is to be imputed and, if so. how big. Of course if they want to hire a dog then the dog will bark out a result which takes all that into account. If they don’t hire a dog they must needs bark themselves.

Jack Harper