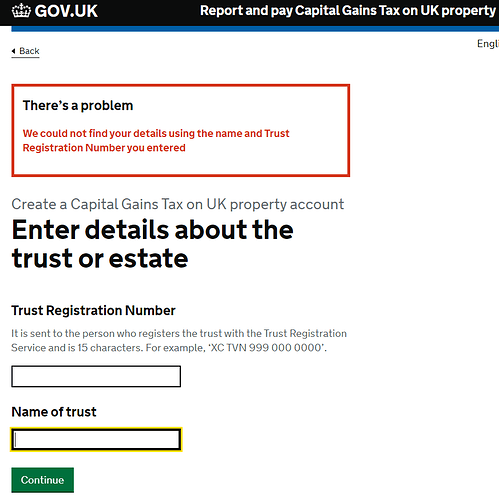

Where a non-UK resident trust that has not previously completed the Trust Register disposes of UK real estate, it needs to complete the Trust Register first (unless no NRCGT is payable per TRSM25030). It used to be the case that the trustees could create a CGT on UK Property Account as soon as a Trust Register submission was made, using the 15 digit ‘Trust Registration Number’ generated by the submission, but now it is not possible to do this without waiting for a UTR to be issued and then ‘claiming the trust’ first (the below error message results until the ‘claiming the trust’ process is undertaken). As it takes several weeks for a UTR letter to be received offshore, this means it is virtually impossible to meet the 60 day reporting deadline. I’ve tried contacting HMRC but to no avail. Has anyone else experienced this, any tips?

Many thanks

Helen

LTS Tax Limited

I can only say what approach I make to this kind of idiocy. I use the good old steam packet (Non-Digital by Default) and send a letter outlining the facts and indicating what action I will take if any interest or penalty is assessed. This kind of CGT is now incorporated in the penalty provisions of Schs 55 and 56 FA 2009. Statutory references go down well.The penalty for failure to make a return is £100 if corrected within 3 months. Then there are daily penalties but assessments must be made, there is an appeal (which can quash HMRC’s decision), and a reasonable excuse provision. Interest is trickier but see DMBM 405000. If HMRC want to wash their dirty linen before the Tribunal, let them. I actually say that, acting for myself, but you may feel more charitable. Then wait until you get the UTR and carry on.

Sometimes it is hard to get the right HMRC address but fortunately this is provided in CG-App-18-100 by a link:

"Post

General enquiries

Write to HMRC for help with general Capital Gains Tax queries.

You do not need to include a street name, city name or PO box when writing to this address.

Couriers should user a different address.

Capital Gains Tax Queries

HM Revenue and Customs

BX9 1AS

United Kingdom

Courier deliveries to HMRC: PO Box and BX postcodes

Post

Couriers should use this address for all post items being delivered to a:

· postcode beginning with BX5 or BX9

· PO box

· HMRC site that does not accept post

If you need a recipient phone number use 0300 200 3300.

HM Revenue and Customs

BP8002

Benton Park View

Newcastle Upon Tyne

NE98 1ZZ

United Kingdom"

Jack Harper

Many thanks for your suggestion, we will write to HMRC in each case, reiterating the problem each time, hopefully this may lead for them to consider making changes to their system in future…?

HMRC won’t reply to us as agent as they generally don’t accept a 64-8 without a UTR, also they won’t be able to trace the letter in future without a UTR, in our experience. We’ll need to write to them anyway when we receive the inevitable tax return requests, to explain that there is no UK income and to ask for them to be rescinded.

We do miss the old NRCGT returns that could quickly and easily be completed online!

Could you not draft a letter for your clients to write? You would surely need instructions to send your own and it might be the kind of letter, twisting the tiger’s tail, that clients might wish to approve as to content and strategy.

Jack Harper